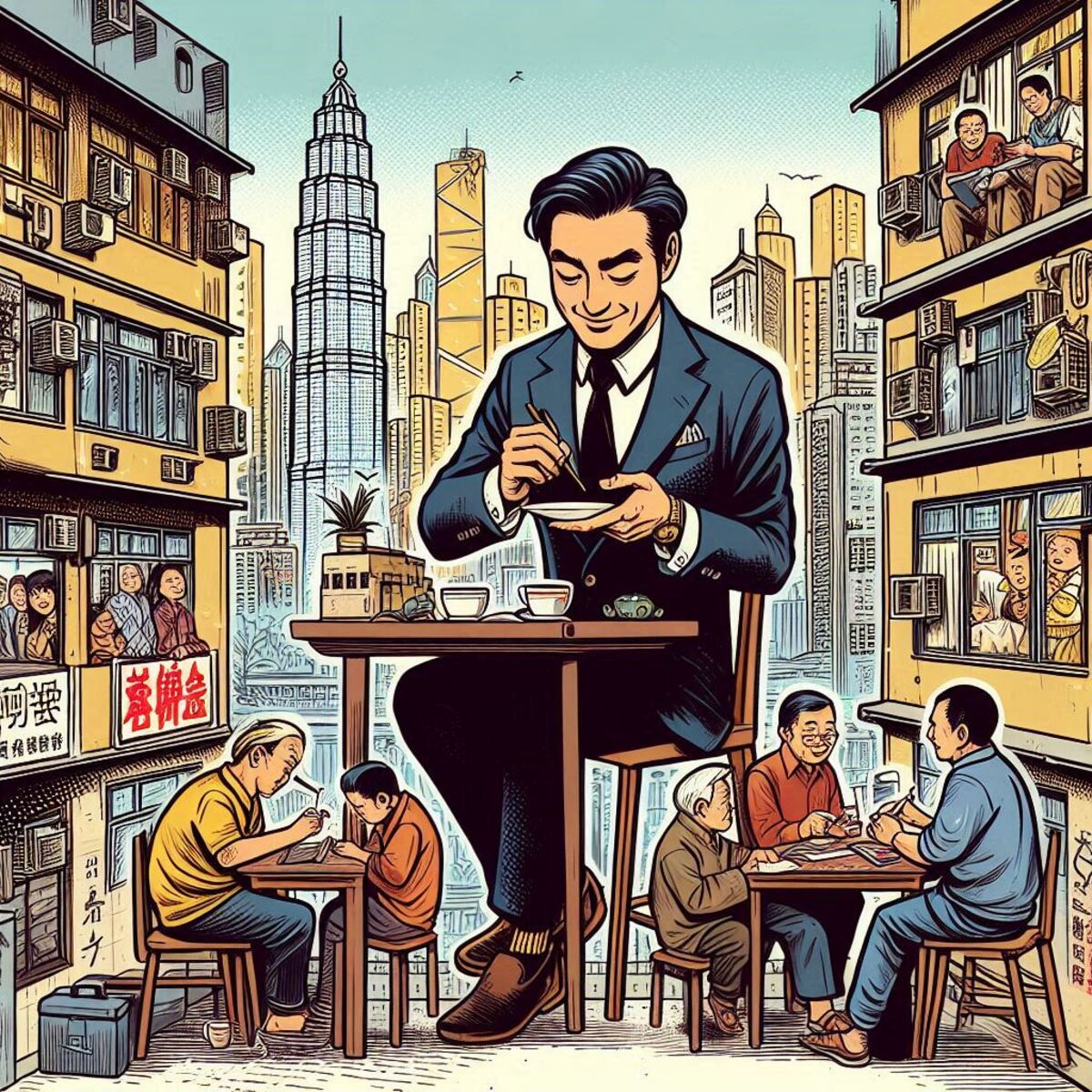

“Small but Expensive.” “One Bedroom for ¥100 Million?”

To some, Tokyo’s ultra-compact, high-priced central apartments may appear puzzling.

But for Hong Kong’s affluent buyers, such properties are strategic opportunities. In fact, the compact size is precisely what enhances their appeal.

So why do they intentionally choose smaller units in central Tokyo?

◆ Understanding the Hong Kong Perspective on Real Estate

Hong Kong’s property culture is shaped by long-standing structural realities:

-

Severe land scarcity

-

Vertical living with compact floor plans as the norm

-

A natural familiarity with efficiently designed small spaces

-

A high-turnover rental market with strong focus on yield

Against this backdrop, Tokyo’s 30–50㎡ one-bedroom and studio units feel inherently familiar—and even desirable—to Hong Kong investors.

◆ Compact Units: Agile, Multi-Functional Assets

For Hong Kong’s affluent investors, the ideal property is one that offers maximum flexibility across use, leasing, and resale.

In this regard, compact central Tokyo apartments deliver key strategic advantages:

-

An ideal Tokyo base for business travel and short-term stays

-

High demand among affluent tenants for premium monthly rentals

-

Smaller floor space means lower capital entry and easier portfolio diversification

-

Highly liquid and easily rentable—even internationally—with a clear and efficient exit strategy

These qualities make compact units a low-risk, high-agility asset class.

◆ The Remarkable Stability of Central Tokyo’s One-Bedroom Apartments

In prime districts such as Minato and Shibuya, one-bedroom units consistently command strong prices, regardless of building age.

This enduring value is driven by key factors:

-

A high proportion of cash buyers with no reliance on mortgages

-

Limited resale inventory, with few owners willing to sell their units

-

Sustained demand from overseas buyers seeking second homes in central Tokyo

As a result, investors perceive these compact properties as low-risk, high-confidence assets, where size does not compromise financial security.

◆ It’s Not Just Acceptable to Be Small—It’s Strategically Better

For Hong Kong’s affluent investors, size is a strategic decision. The right dimensions depend on the intended purpose:

-

For family living: a spacious home in the suburbs

-

For investment: a compact, centrally located unit

-

For personal use: a high-floor one-bedroom residence

In this context, “compact” is a reasonable choice of precision and purpose.

◆ A Generational Shift Among Thailand’s Affluent Buyers

In recent years, Thailand’s younger affluent generation has embraced a more purpose-driven approach to property ownership.

The prevailing mindset is evolving:

-

From “bigger means better”

-

To “better means more usable”

Within this framework, compact luxury residences in Tokyo—such as 1LDK units and high-spec apartments in the 30㎡ range—are increasingly recognized as smart, strategic acquisitions.

◆ Summary: “Small but Strong” Is Becoming the Global Standard

There is value that cannot be measured in square meters.

In fact, smaller units often yield higher returns, require less maintenance, and offer greater flexibility across use cases.

This principle has long been understood by investors in Hong Kong.

Now, the world’s affluent class is beginning to follow suit—recognizing the enduring appeal of “compact yet resilient”.