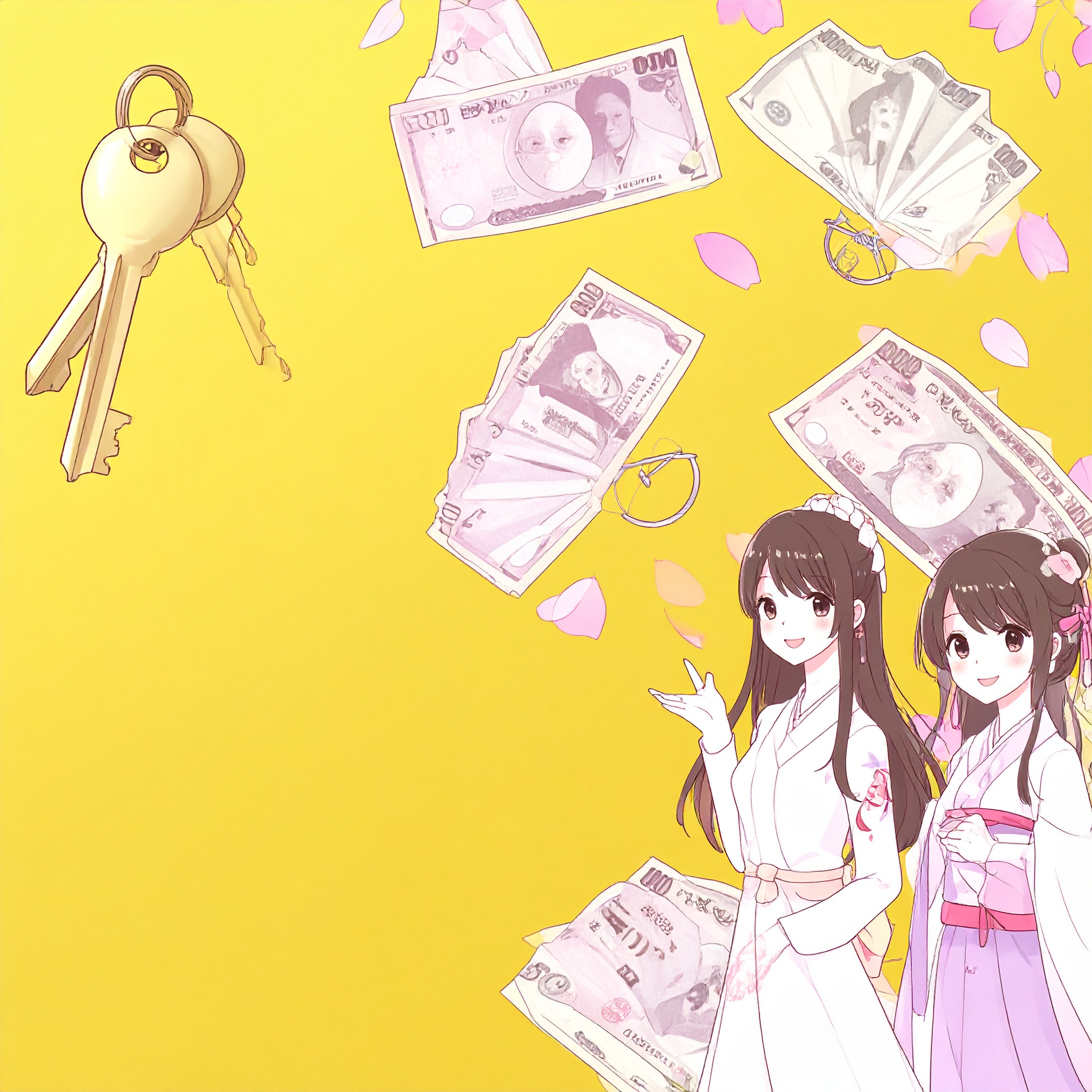

In Japan’s rental housing market, initial costs often include “shikikin” (security deposit) and “reikin” (key money). Among these, key money refers to a non-refundable payment made to the landlord—essentially a gesture of appreciation with no expectation of return.

Against this backdrop, listings that feature “zero key money” appear especially appealing to cost-conscious tenants. They tend to attract individuals seeking short-term accommodations or foreign residents aiming to minimize relocation expenses due to their seemingly lower upfront costs.

However, a “zero key money” offer does not necessarily equate to a genuine financial advantage. A closer look at the lease conditions, monthly rent, and associated fees often reveals hidden costs that may offset the initial savings. This article explores the key considerations and underlying mechanisms behind zero key money properties.

Understanding the Nature of Key Money

Key money is a one-time payment made by the tenant to the landlord at the start of the lease. Unlike a security deposit, it is non-refundable upon vacating the property. Historically, this payment functioned as a token of appreciation—a gesture of gratitude for the opportunity to rent the property—and is not legally mandated.

Today, the standard amount of key money typically equals one month’s rent, though this varies considerably by region. In major metropolitan areas, it may amount to two months’ rent, while in regional areas it can be as low as half a month. Factors such as the building’s age, amenities, and market demand also influence whether key money is required. As a result, listings that advertise “no key money” can initially appear more cost-effective.

Why Do Zero Key Money Properties Exist?

Properties with no key money requirement are often part of a strategic approach by landlords to attract tenants by lowering the upfront financial burden. This incentive is typically employed in the following situations:

-

The unit has remained vacant for an extended period.

-

There is significant competition in the area, prompting landlords to differentiate on price.

-

The property is older and lacks modern amenities or unique appeal.

-

The listing is posted during off-peak seasons when tenant demand is low.

-

A limited-time promotional campaign is being used to boost occupancy.

While these strategies aim to maintain rental income for the landlord, they also present cost-saving opportunities for prospective tenants.

That said, understanding the specific reason behind the absence of key money is essential. Tenants should assess the broader context of the lease conditions to make a truly informed decision.

When Rent Is Priced Above Market Rates

Even if a property advertises “zero key money,” the monthly rent may be set above the local market average. In such cases, landlords may be attempting to recoup costs not through upfront fees, but via ongoing rental income.

For example, if a unit commands ¥5,000 more per month than a comparable property in the same area and with the same layout, this results in an extra ¥60,000 annually—or ¥120,000 over a two-year lease. In such scenarios, even with the payment of one month’s key money, another property could ultimately prove more economical.

Rather than focusing solely on initial expenses, prospective tenants—especially those considering long-term stays—should evaluate the total cost of occupancy over a two-year period. This comprehensive perspective provides a more accurate measure of value.

Higher Move-Out and Ancillary Costs May Offset the Benefit

In some cases, the absence of key money is offset by elevated costs at the time of move-out—such as cleaning fees or restoration charges. A common example is a lease agreement that includes a clause stating a flat-rate cleaning fee, often amounting to a significant sum upon vacating the property.

Moreover, tenants may encounter inflated upfront costs under the guise of miscellaneous charges—such as lock replacement, deodorization treatments, air conditioning maintenance, or even fire extinguisher installation.

What may initially appear as a cost-saving opportunity due to the lack of key money can, in reality, result in overall expenses comparable to—or even exceeding—those of other listings. It is therefore crucial to carefully review the full breakdown of associated fees before making a commitment.

Early Termination Penalties May Apply

In many “zero key money” rental agreements, a special clause may impose an early termination penalty. For instance, tenants who vacate within the first year of the lease may be required to pay a penalty equivalent to one month’s rent.

This clause is typically implemented by landlords as a safeguard against vacancy risks. In lieu of collecting key money upfront, the landlord offers more lenient entry terms with the expectation of long-term tenancy. However, should the tenant leave prematurely, a financial penalty ensures that the landlord’s interests are protected.

Such provisions are often found in the “special conditions” section of the lease agreement and may not be immediately obvious. Therefore, it is essential to review the contract thoroughly before signing.

“Zero-Zero” Properties May Involve Stricter Tenant Screening

So-called “zero-zero properties”—those requiring neither a security deposit nor key money—can significantly reduce initial costs for tenants. However, these listings often come with stricter screening criteria imposed by guarantor companies.

This is largely due to the elevated risk borne by landlords in the event of rent delinquency, as they have no deposit to fall back on. Consequently, applicants with unstable income, no guarantor, or limited residency periods may face higher rejection rates during the approval process.

Additionally, such properties may include inflated charges for mandatory guarantor services or fire insurance premiums. Over time, these added costs can diminish or even negate the financial advantage of the reduced move-in fees.

Evaluating Total Cost and Risk Is Key to Informed Decision-Making

Selecting a property based solely on the absence of key money may lead to unforeseen financial burdens after move-in. What truly matters is a comprehensive evaluation of the total cost—from initial move-in to final move-out—as well as considerations such as quality of life, contractual flexibility, and the property’s overall suitability to one’s lifestyle.